This week’s essay is by Gideon Powell. CEO at Cholla Inc. A man on a mission to make Energy Abundance a reality in our lifetimes. This essay will inspire you.

This week’s code: “Ingenuity” gets you 60k Sats off any order on The Bitcoin Times.

ONLY available to the first 10 people here: The Bitcoin Times Shop

Bitcoin has the potential to transform society as radically as the internet did. It enables people to securely store value and send it instantly anywhere in the world What is energy? What value does energy provide and how does it relate to the ultimate resource of human ingenuity? Is Bitcoin simply an energy intensive commodity overwhelming limited energy resources or does it have a role in humanity’s never ending march to greater heights and new frontiers?

To gain deeper insight into the relationship between energy, Bitcoin and the cascade of innovations set in motion by the human mind we will draw inspiration from the very underrated economist Julian Simon, who wrote: “The Ultimate Resource”.

“Our supplies of natural resources are not finite in any economic sense. Nor does past experience give reason to expect natural resources to become more scarce.”

Julian Simon

Unfounded Fears

Simon was a true pioneer of thought, and one of the first thinkers to merge physics with economics. He showed us that historical fears of energy scarcity would almost always underestimate the remarkable abilities of humans to innovate, giving rise to the adage, "Necessity is the mother of all invention." This is why he called the human mind, the Ultimate Resource.

His thinking could summed up as the opposite to the Malthusian interpretation of the world. It was, in effect, the innovative and abundant interpretation.

When a resource dwindles or is highly valued there are a number of possible messages being communicated by a clear signal known as rising price. One set of messages is a call to innovate. It interprets the signal as an incentive to problem solve by either:

Seeking more of the limited or highly valued resource through exploration and/or innovation, and

Exploring new or improved ways to lower the cost of alternative resources.

Alternatively, the rising price signal can also be interpreted from with a scarcity mindset, leading to fear and causing some to look for ways to control resource allocation by broadcasting:

We’re running out of resource {x}!

We need to stop using resource {X}!

We need to use governmental control to force the desired outcome

We’ve seen this time and again, particularly when oil prices have climbed. Alarms from media outlets and hired ‘experts’ proclaim: "We're running out of oil!" Yet, despite such claims, price increases have continuously been met with renewed efforts by energy entrepreneurs who invest their time, talents and treasures to reduce the price of oil, or energy in general, by:

Producing more of it through exploration and/or innovation

Explore new or improved ways to lower the cost of alternative resources to oil.

While history and the innovative interpretation have and continue to contradict the Malthusian, scarcity-driven interpretation of a rising price signal, mainstream headlines continue to bombard us with new messages of resourcelessness. These contemporary narratives caution against consumption, they promote fears about climate change and continue to suggest that nature is brittle. Their rhetoric posits that we lack the tools and incentives to ameliorate our situation, thus necessitating governmental forced intervention and our sacrificing of modern amenities.

We must beware of narrow perspectives and false narratives that have time and again been proven wrong. We must develop an alternative and more actionable, resourceful, vision of the future. While it is undeniable that human activities impact the environment and developed nations consume vast resources, it's myopic to attribute the global population's sustainability issues solely to consumption patterns and short term observations. Scarcity-based observations lead us to misconstrue root causes, in the same way that “looking for red” will cause you to miss all of the blue. Immediate, short-term solutions are often borne from misinterpretations and they tend to favor restrictive, top-down, centrally planned actions, which in turn require convoluted regulatory frameworks with unclear governing bodies to manage them. Together with a scarcity mindset, we create more problems and begin to mistakenly conclude that no voluntary, mutually beneficial solutions exist.

What’s needed instead is a longer-term, innovative and resourceful perspective. One which recognises that, as Julian Simon said, human ingenuity is the ultimate resource, and its suppression is the ultimate limiter. If we can successfully change this psychological framing, actionable and mutually beneficial solutions can and will emerge. History has proven this time and again!

The objective of this essay is to do just that. To broaden your perspective and present a more hopeful vision of the future. A future which anyone can contribute positively toward. I will demonstrate the power of an abundance mindset by highlighting how principles of human progress have transformed formidable challenges like pollution, waste, and growing populations into opportunities for humans to adapt and innovate not only without sacrificing modern amenities, but by enhancing them.

A Brief History of Energy Markets

Problems lead to solutions, which inevitably lead to new problems, which if not interrupted, will lead to new solutions. And so the story goes.

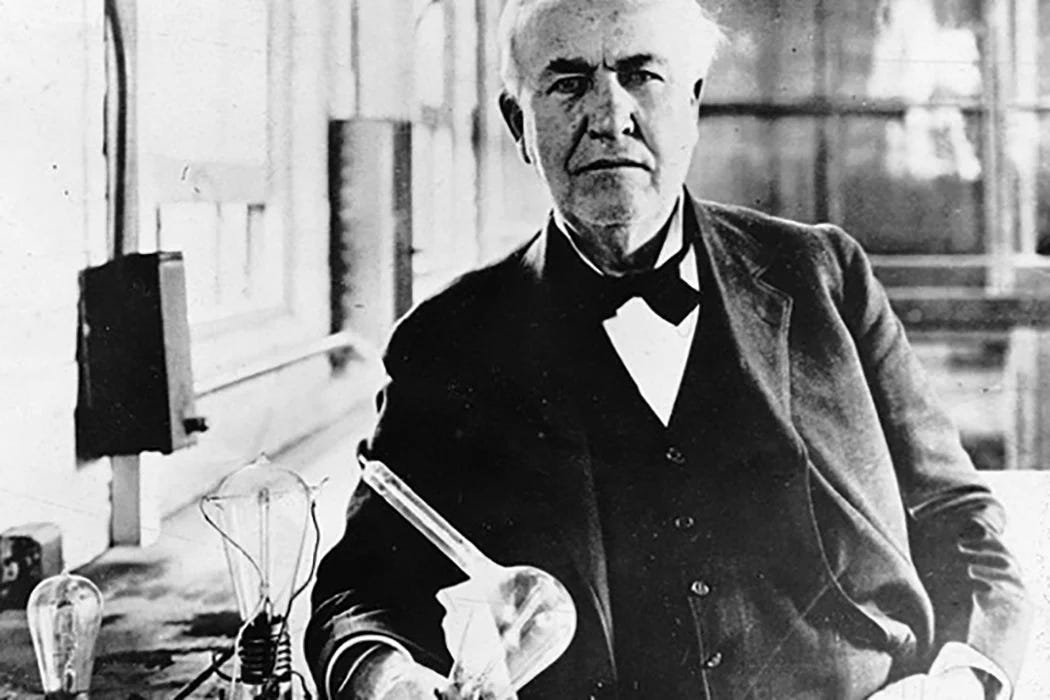

This is reflected in the domain of energy, with Thomas Edison coming to mind as a true pioneer. In the late 19th century he invented the original electricity grid when he opened the Pearl Street Station in lower Manhattan, New York City. The station, which began operations on September 4, 1882 and supplied electricity to nearby businesses and homes, illuminating nearby streets and establishments with electric light, is often considered the first practical electricity distribution grid. It was monumental because it replaced less efficient gas lighting and provided a safer and more affordable energy source for more people. Edison's DC system was a centralized grid structure that distributed electrical power to consumers within a reasonable distance from the power station. The challenge with DC, however, was that it could not be transmitted over long distances without significant power loss, which became a significant limitation as demands for electric power grew and required transmission over greater distances.

Despite his brilliance, he failed to recognise alternative current (AC) systems as superior for transmission, and also failed to conceptualize the subsequent evolutionary phase – the amalgamation of electricity production within centralized power plants and the birth of a national grid. The grid he was unable to see at the time emerged naturally as entrepreneurs came to capitalize on improved economics through increased utilization rates and economies of scale.

Enter Sam Insull. A pioneering energy entrepreneur with an abundance mindset and an ambitious vision. He built his company through financing and operating power generation & transmission for manufacturing companies, who were previously self-financing their own energy generation. In the same way that the steam engine liberated manufacturers from reliance on waterways, Insull liberated businesses from the necessity to build their own vertically integrated power plants, and in doing so, pioneered the transition towards shared utilities. By bearing the capital expenditure associated with building superior power plants and transmission lines, he liberated capital for manufacturers which in turn created incentives for them to stop wasting time, money and resources on their own power plants, and channel investments into their core competencies. In this way, he effectively lowered the cost of electricity and initiated what Charles Schumpeter coined the “virtuous cycles of mutual benefit.” This laid the foundation for a new wave of rapid innovation and economic growth. It enabled electrified household appliances and spurred new businesses across various sectors like technology, healthcare, and space exploration, which continue to enhance our lives and economies today.

We see this story time and time again.

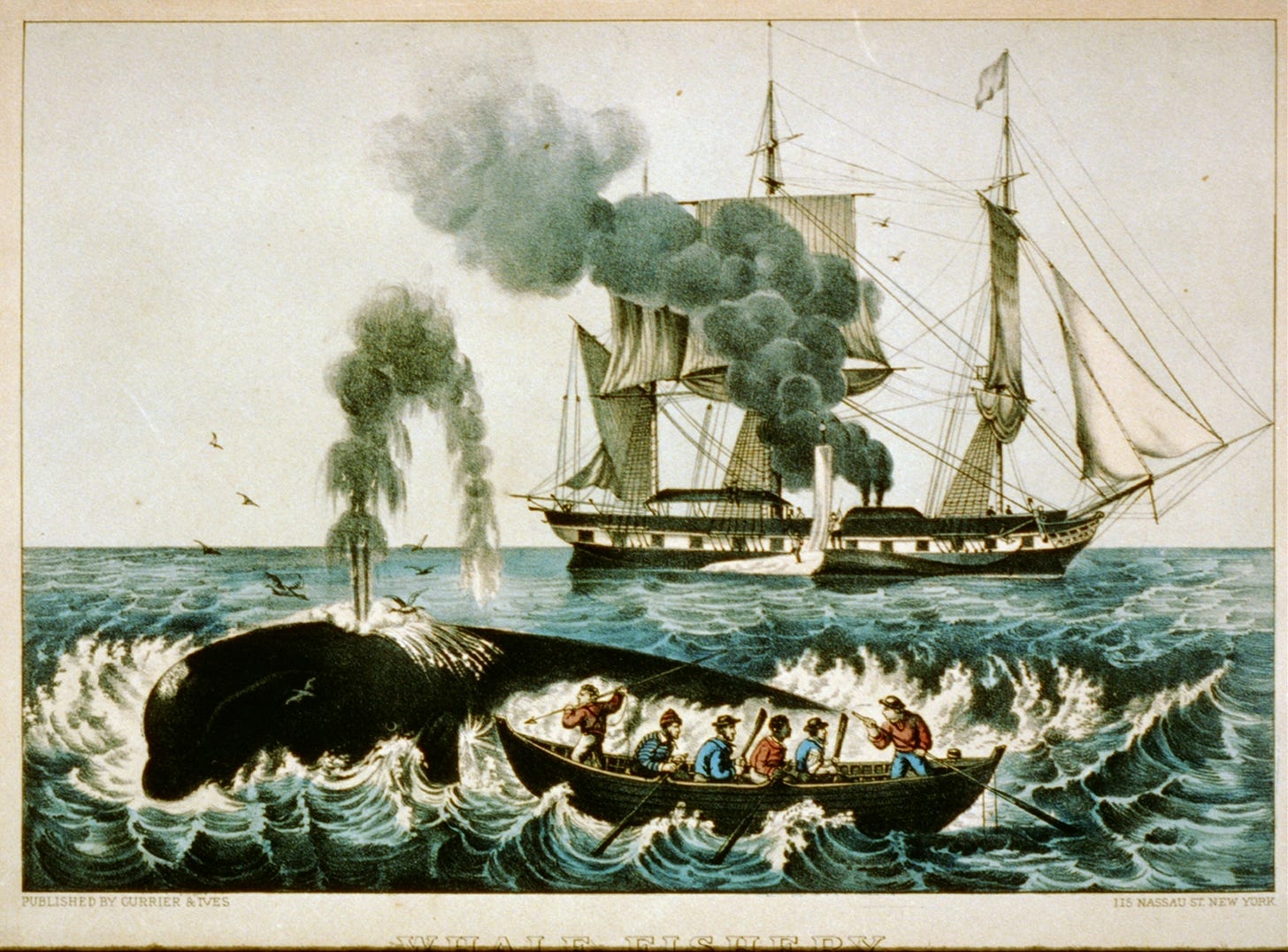

Prior to the electricity revolution, we had oil. By the mid 19th century, a whole range of whale species neared extinction because of the high value modern, rapidly growing societies around the world placed on the oil extracted from their blubber. Why? Society needed light! More people meant more demand. This was a problem, and it looked insoluble. Ironically, it was the commercialization of kerosene led by Standard Oil that swiftly made whale hunting unprofitable. The oil companies were the original “saved the whales” team.

Fast forward to recent decades and the Solar Energy revolution. Whatever your position on this technology, there’s no doubt that human ingenuity, the ultimate resource, has driven the unit cost of solar energy down significantly. When first introduced, solar panels were prohibitively expensive. Yet, energy entrepreneurs kept innovating, and today they are accessible for remote villages around the globe. You might argue that this is only because of artificial subsidies, and while you might be right, the reality is that the subsidies merely fuelled human ingenuity. They redirected where people’s actual efforts went, which, when we discuss subsidies later, we will find also have hidden costs.

Another, more concrete example comes from the mid-2000s, when concerns about America's dwindling natural gas reserves and surging prices sparked the horizontal fracking revolution. Much like Standard Oil “came out of nowhere” during an age of crisis, and flooded the United States with abundant energy, so too did Fracking lead to an abundance of natural gas, causing prices to plummet 80-90% and breathing new life into the American, and global, economy. This new energy, literally and metaphorically speaking, bolstered American manufacturing and redefined geopolitical dynamics. It saved Americans and their trading partners more money than any tax cuts or other cost curbing measures have ever done.

A similar thing happened with oil. Following the alleviation of natural gas scarcity in ~2010, and amidst growing concerns about depleting oil reserves, nimble independent oil & gas companies turned their attention here. They didn’t do this as some conglomerate with a centrally planned and dictated directive. They simply heeded the call to action, motivated by the prospect of profit, and applied their expertise to the development of innovations in this new sector. This transfer of knowledge triggered a domestic oil production renaissance, driving down oil prices and transforming America from a net importer to a dominant oil producer. This further enhanced America's energy independence, lowered fuel prices, fostered job growth not only in the sector, but beyond, and bolstered the nation's geopolitical position on the global stage. It was another major “saving” for the American people and the world.

The ramifications of all these advancements are profound. Not only do they enable already complex and affluent societies to continue growing and manage demand, but they create a blueprint for emerging economies to learn and benefit from.

Access to affordable power enables everything from clean drinking water through electrified purification, to better education for more children by making it possible for schools to use digital tools. Affordable electricity supports businesses of all sizes, it enhances safety with well-lit streets, enables improvements in public health, bridges the digital divide by connecting remote areas to the wider world and offers access to previously unattainable information and online markets. In essence, affordable energy becomes a transformative tool that elevates quality of life, propelling prosperity, health, safety, and vast growth opportunities, all which steer individuals toward envisioning and working for a better, brighter and more sustainable future.

Zeal and Innovation

While early pundits could only see as far as “illumination” (if they could see that far at all), the appeal of abundant electricity ultimately went much further. It became a pivotal catalyst for a wave of innovation that shaped and improved the quality of life in the 20th century, literally molding the contemporary world we live in today.

The same went for energy discovered or extracted from other means. Energy abundance made household appliances like refrigerators and washers ubiquitous, the entertainment industry blossomed, cinema and radio broadcasting took off. The manufacturing sector was revolutionized by the electrification of assembly lines, propelling the automobile and aviation sectors. The tech arena burgeoned, paving the way for the digital revolution that spawned transistors, computers, telecommunications, and the internet. Consistent power amplified R&D, spurring advancements in medicine, chip technology, and space exploration.

I find myself often asking: what new industries and valuable opportunities might emerge, if we get out of our own way? What will catalyze yet another transformative wave across the global landscape? And what needs to happen in order for that to occur?

One can find answers to these questions by traversing the stories of successful energy transitions from the past. You will find a series of common threads emerging:

An unwavering spirit of entrepreneurial zeal,

Permissionless innovation, and

A relentless pursuit toward progress and profit.

Thomas Edison, who we discussed earlier, and whose inventive prowess laid the foundations for the electric grid, wasn’t solely driven by a mere aspiration to innovate; he was propelled by a potential profit motive. The undercurrents of America’s culture, built on robust property rights and intellectual property safeguards, offered him a fertile ground to sow and reap the benefits of his inventiveness. This ecosystem inherently supported bottom-up solutions, where individuals, buoyed by self-agency and a permissionless cultural spirit, found pathways to create value and enact change. Sam Insull’s pursuit to democratize electricity also relied heavily on these principles. He didn’t need overt permission or prodding to innovate, but was motivated by a raw profit incentive and a compelling vision. His model, a confluence of profitability, re-investment, and bottom-up solutions, unlocked a cascade of economic vitality and innovation that changed the world.

Standard Oil, too, emerged as a formidable entity not in spite of the whale oil industry, but perhaps because of it. John D. Rockefeller’s ability to grow his company rested not merely on predatory pricing but was built upon his capability to innovate, reduce costs, and subsequently, prices — all while enhancing the quality of his products. In essence, Rockefeller was sustained by a profit motive validated by consumers and an environment conducive to entrepreneurship.

The American fracking revolution shared a similar spirit. What stands out is not necessarily the superior geologies of the regions, but a clearly superior cultural and regulatory environment that supports and cultivates the entrepreneurial spirit. This is why such revolutions didn’t occur in regions like California or Saudi Arabia. Their regulatory and cultural environments often stifle entrepreneurship and impede bottom-up, permissionless innovation.

We are now at the dawn of a new age, and in it, we encounter the new frontier of Bitcoin mining: an arena that, like its predecessors, thrives on innovation and the raw profit motive. A place where anyone, regardless of stature, can become an energy entrepreneur. Bitcoin as a tool — permissionless and accessible — and mining as a means, together create a paradigm where lowering the price of power translates to direct, tangible rewards. Principles of human progress: profit motives, permissionless innovation, bottom-up solutions, and an unwavering adherence to creating mutually beneficial value for consumers, are once more present.

In the same way prior entrepreneurs navigated their respective epochs, Bitcoin Energy entrepreneurs will today leverage the same principles to pave pathways that significantly uplift societal standards and increase economic potential.

But why such an emphasis on Bitcoin? We will answer that in a moment. But before we do, let us first attend to the question of subsidies.

What about subsidies?

Human beings are human beings. We are always looking to tinker, learn, manage and create toward some end. Our interventions often result in a mix of externalities, often positive, but when we try to micro or over-manage complex processes such as economics or innovation, we generally create more negative outcomes.

The tricky thing about this is it’s hard to notice or measure. Interventions in the form of subsidies are such an example. They often look great on the surface, but can have ramifications that are unforeseen or which create new problems. As usual, the truth is more nuanced. The history of energy development is full of interesting examples. Government subsidies were extended to whalers in the 19th century, they fueled the rise of crude oil in America and more recently, helped to make solar and wind more affordable to end users. And while it’s true they’ve helped stimulate energy innovations by providing an initial thrust, and thus helped catalyze the industries, they’ve also resulted in negative consequences. For example, whaling subsidies almost drove whales to extinction, and government intervention, despite attempting the opposite, helped to stifle competition and made Standard Oil into a greater monopoly than it otherwise may have been in a more free market, subject to greater competition. Solar & wind energy are a more recent example. While costs have come down significantly, the subsidies have led to not only acute environmental damage with the mining of rare earth minerals, but given us a false sense of the true cost of these forms of energy. This has resulted in more dependency on weather events and thus less reliability in the energy grids millions rely on.

Things are ultimately more complex than they seem at first glance, and we must understand this as we move forward on our journey toward energy abundance. We must remember that genuine, sustained propulsion towards progress in any energy sectors—be it in whaling, oil, nuclear, or solar—comes not from “subsidies” but from the undeterred innovativeness of humans and their persistent quest for efficient and novel solutions, which are oftentimes motivated by profit.

We must recognise that the only real sustainable solution to problems is human ingenuity. We must salute human inventive prowess and recognize that, though subsidies may set the stage, it is our inherent innovative spirit that converts opportunities into substantial progress, crafting our future energy and environmental tapestry.

We must develop a narrative that posits a future where policies ensure equitable competition, absent of preferential subsidies, to cultivate a terrain where innovations are organically birthed, unfettered by fiscal aids and uninhibited by taxpayer burdens, which can chisel a pathway toward a self-sustaining and abundant energy future.

Money & Energy

We don’t have to go deep into economics, semantics, metaphysics and philosophy in order to make the connection between energy and money. We work for money. “Work” in and of itself implies an energy expenditure, or an input of energy. Currency, electrical and tidal currents, current (as in present, or in focus at present) all convey a movement of energies over time. Energy applied over time is power, and money also represents purchasing power, an economic energy. A battery stores energy. But you can also get charged for battery, or prosecuted for battery. That is projection of energy, or in that case, unlawful projection of energy. Bitcoin is a battery of ever-expanding encrypted energy in cyberspace. It consumes energy in order to empower the human spirit. It stands with the wheel, the printing press, electricity and oil as one of the most powerful greatest ever human discovery-inventions

Bitcoin has revolutionized the way we understand money. In fact, some might argue that Bitcoin is truly the first ever ‘sound money’ because it is an intertwining of monetary value and energy. Vaclav Smil aptly stated, “Energy is the universal currency.” Bitcoin’s synthesis of money and energy allows us to re-prioritize & re-examine our relationship with energy itself. Energy powers everything, in and out of our world. The proliferation of reliable and affordable energy is the foundation for which liberated, peaceful, civil, and affluent societies are built.

Complex economic structures can be built and sustained when signaling mechanisms (like price) function well and energy is able to flow between nodes. In such an environment, growth is a natural phenomenon. Life wants to expand. Furthermore, in an ecosystem devoid of paper accounting's ability to mimic growth, genuine innovation becomes imperative. Economic agents are propelled by the pressing need to produce, create, and innovate, because demand literally demands it.

Bitcoin Mining is one such example of this demand. It is a manifestation of Julian Simon's notion that the rising price of a resource sends a signal to economic actors to reduce that resource cost. There is a clear incentive and reward: if you want to keep more of your Bitcoins, lower the price of energy. As such it is an incredibly under-appreciated innovation in the realm of energy production and utilization. Historically, clarity on electricity pricing remained elusive and the signals that would call for action were obfuscated, whether through the many steps or intermediaries between production and consumption, or through bureaucracy. As a result, the permissionless & bottom up innovation found in other, simpler industries has remained lacking in the energy industry. Bitcoin has changed this by more tightly tying energy and money together, and is therefore leveraging the principles of human progress by putting the tools of innovation back into the hands of individuals or groups that want to contribute.

Bitcoin: The Apex Load

Bitcoin isn’t only a digital currency; it is an APEX energy load.

What do I mean by that?

Historically, innovating in power markets demanded monumental capital, and the prowess to navigate labyrinthine regulations and long lead times, all without the assurance of a profit in the chance of success. With Bitcoin, this all changes.

Bitcoin can absorb excess energy production that might otherwise go to waste, by ramping up and down quickly in response to fluctuating energy supply and demand. Unlike traditional energy loads that require a consistent and steady supply of electricity, Bitcoin's energy needs are flexible. Miners can relocate to areas where there is an abundance of cheaper or underutilized energy. This adaptability makes Bitcoin an ideal consumer of energy sources that are otherwise hard to store or transport, such as wind or solar energy produced at times when there is low demand.

Bitcoin mining combines flexible capacity, direct monetary reward, a growing market full of innovation, and the opportunity to profitability push the boundaries of computation, cooling technologies, and power systems. Bitcoin makes possible a future where energy entrepreneurs across the globe, from the remote regions of Africa to the expansive plains of West Texas, are able to rise above geographical and bureaucratic barriers so they can innovate, derive value, and potentially propel the world into the next era of energy utilization and management.

Bitcoin mining is already turning underutilized and stranded energy assets into more profitable ventures. This is shifting the very landscape of power markets and is particularly transformative for remote or impoverished areas with untapped energy resources. Bitcoin mining offers a novel way to monetize these assets without the need for heavy infrastructure investment. This is a revolutionary departure from the traditional barriers to entry in power markets, reducing the risk and cost involved in tapping into these resources.

Bitcoin is the catalyst for a more decentralized and efficient energy market. With it the kind of principles that shaped America's energy history are now able to scale worldwide and shape the future of the global energy landscape. And in this, I argue that we're just warming up, preparing to embark on an exciting, transformative journey that could once again redefine our societal structures, economic modalities, and the very way we interact with and perceive energy. It’s not just a chapter in the annals of energy history; it's a continuum of a story that finds its roots in the very principles that have perennially fueled progress, innovation, and entrepreneurial success.

Our world is rich, brimming with untapped energy resources. Long-recognized potential across the globe: from the stranded gas of Alaska's north slope, tidal energy located far from population centers, Indonesia's undrilled geothermal to the gargantuan solar resources of Chile's Atacama Desert and the Western Sahara's windy plains. Though these abundant energy opportunities have always harbored latent potential, their full realization has remained unattainable without an economic catalyst.

Bitcoin fixes this.

Helping fuel and incubate the ideas in our minds is the velocity of modern communications and the power of the internet. It allows information, knowledge and ideas to be shared with other energy entrepreneurs and iterated on. Such a process can breathe economic vitality into the untapped energy resources of this world and beyond. Just as James Insull envisioned using economies of scale to increase utilization and lower costs, so too should energy entrepreneurs today be encouraged to dream big and envision a world with greater energy abundance. And with Bitcoin, they can, because profit is assured if they can successfully innovate and lower the cost of energy.

Like the steam engine liberated manufacturers and enabled them to locate away from running water, Bitcoin’s location agnostic load, untethered to any region of this world (and beyond) makes it possible for energy entrepreneurs to innovate anywhere. The best opportunities will be found where the greatest of human ambitions lie.

Such an alliance between money, energy and ingenuity won’t just reduce costs; it will spark further exploration, innovation, and development. Success breeds further success, just as the first oil well in West Texas, a barren flatland, lowered the risk and improved the economics of other visions to join in the journey of nearby explosion. And as these ventures find their footing, mature, and flourish, they hold the promise to redirect their power, lighting up the lives of both remote villages and teeming metropolises.

Even the concept of subsidies is being re-imagined. In Texas, ERCOT uses ancillary payments as a financial lever, or an insurance of sorts, for grid operators to ensure resilience in times of low generation or high demand. With the advent of Bitcoin mining, a new, flexible load has entered the space and created upward pressure for the generation of more total energy - a good thing - while simultaneously allowing for data-drive, real time adaptation when needed. In other words, Bitcoin Mining demands more energy, it sucks up any excess energy being produced, and if there is a need for energy to be used for other things (heat on freezing cold day, A/C a super hot week) then miners can shut off as they are incentivized to do so! This Demand Response or economic curtailment has become an inherent part of a Bitcoin miner’s operational playbook. It is mutually beneficial for grid operators, ratepayers, and bitcoin miners themselves, and is not possible at scale, with any other power-consuming alternative.

As this process continues, the entire industry gathers hard, empirical data that will further refine this resilient, flexible and robust energy infrastructure. Combined with a real monetary incentive and instant payment technologies like Lightning, we can ensure money is allocated in a way that best serves the grid stakeholders' need for resilience, while also lowering the financial burden imposed on ratepayers to ensure resilience. Bitcoin mining, thus, transcends its primary function as a decentralized monetary network, and slowly integrates with energy grids. It becomes a symbiotic catalyst, nudging us towards an age where subsidies and incentive structures are not just established and abolished overnight, but are intelligently and efficaciously developed, re-examined and applied in order to best allocate resources and achieve reliable and affordable power for the lowest cost to ratepayers. In this light we envision a future where policy, innovation, and decentralized flexible loads coalesce, leading to more benefits for grid operators, ratepayers, and bitcoin miners alike. With Bitcoin mining operating at scale, we can anticipate bigger, better, smarter and more efficient energy infrastructure and regulatory frameworks that reward all stakeholders

A bigger, better, brighter future

Bitcoin is more than just a technological renaissance. It's a socio-economic upgrade that is accelerating our path toward energy abundance. We now have tools to set energy entrepreneurs free. They can seek out new domains and territories, they can develop or adopt new methods and technologies, they can transform energy directly into money, all without asking for permission.

Bitcoin is a true zero to one innovation, expanding human potential. Bitcoin mining is not only about harnessing computational power, but something deeper. It’s about reflecting what the decentralized and permissionless ethos stands for. Just as we weigh the value of any industry by its contributions versus its consumption, it's imperative to gain an understanding of the multifaceted benefits Bitcoin offers its users in exchange for the energy it consumers, ie: a permissionless, decentralized, borderless, and secure monetary system, underpinned by an energy framework that rewards efficiency and efficacy. Think about how powerful that is.

With the growth of Bitcoin's size comes a signal to more energy entrepreneurs, to put more of their focus on energy innovation. This is the ultimate resource. As miners globally compete, they are inexorably drawn to regions abundant with the lowest cost energy opportunities, and they are continually optimizing for cost and efficiency.

As mentioned earlier, this is transforming the energy landscape. Energy companies, who yesterday were traditional powerhouses, are today transitioning into becoming monetary validators! And much like the wildcatters, today's “compute-cowboys”, armed with expertise and experience, like the pioneers who came before them, are wielding the tools, knowledge to shape the future. They draw inspiration from the likes of both Satoshi Nakamoto, Thomas Edison and Sam Insull. They are modern-day trailblazers, best equipped to reimagine a bigger, better, brighter energy future. They can envision a world where nascent power technologies, bolstered by Bitcoin mining, can scale to foster synergies that extend benefits beyond just mining and production, but on through to the heart of the communities they serve. Today we stand at the edge of an age of unprecedented energy abundance. This isn't merely a continuation of the past; it's the dawn of a new revolution, promising a future that will eclipse the marvels of the Industrial and Technological Revolutions combined.

The power to innovate energy is the hands of the people and As Julian Simon aptly noted:

“The ultimate resource is people—especially skilled, spirited, and hopeful young people endowed with liberty—who will exert their wills and imaginations for their own benefits, and so inevitably they will benefit the rest of us as well.”

Let's champion this future, drive the principles of human progress, innovation, and a shared vision of prosperity and energy abundance for all. We are just getting warmed up.

Gideon Powell

CEO, Cholla Inc

October, 2023

Read the essay here, along with all prior essays on The Bitcoin Times.

Remember to subscribe. And as promised, for the next TEN orders, the following code will get you 60,000 Sats off the price of The Energy Edition (or any bundle of issues you’d like to buy): “INGENUITY”.